will salt deduction be eliminated

IRS Publication 600. Why the SALT Deduction Matters.

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

The topic goes beyond simple politics.

. Under current law the cap would expire that year. Prior to enactment of the law known as the Tax Cuts and. S social spending and climate package.

Eliminating the SALT Deduction Cap Conventional Revenue Estimates Billions of Dollars. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031. Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government.

Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. The BBBA would raise the SALT deduction limitation from 10000 per year to 80000 per year from 2021 through 2030 lower it to 10000 in 2031 and then eliminate it.

Mondaire Jones the bill would allow New Yorkers to fully deduct their state and local taxes. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. Taxpayers cant get out of them.

Removing the SALT deduction helps accomplish this goal. A Democratic proposal aims. By this logic we should get rid of all tax deductions since most lower and middle income households dont itemize their deductions.

First instituted our federal income tax. A basic principle of taxation is that all income or consumption goods under a consumption tax should be taxed exactly once. It should be eliminated not expanded.

SALT change on ice in the Senate. IRS Publication 600 was. SALT deduction New York.

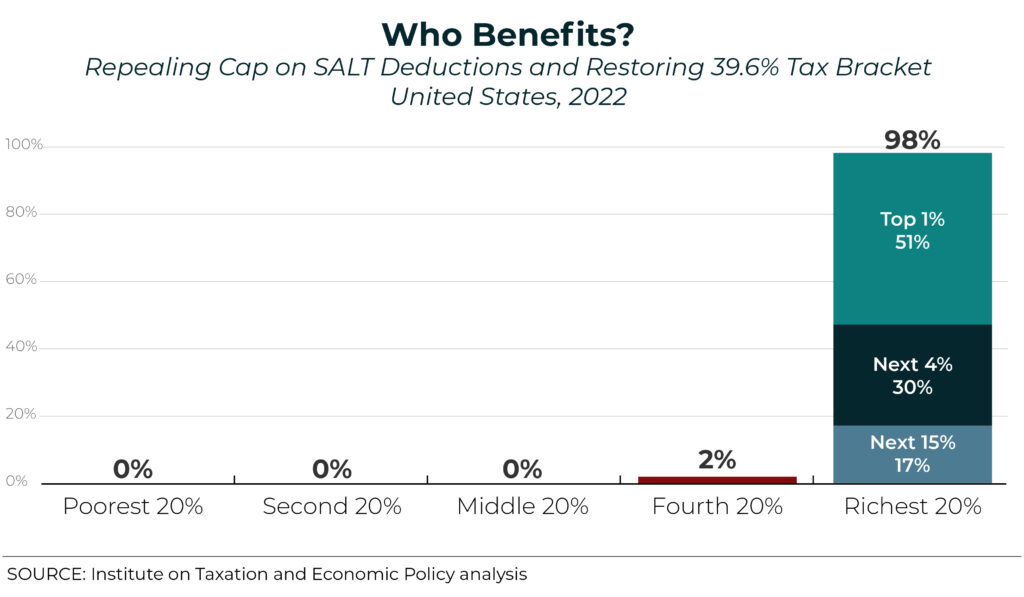

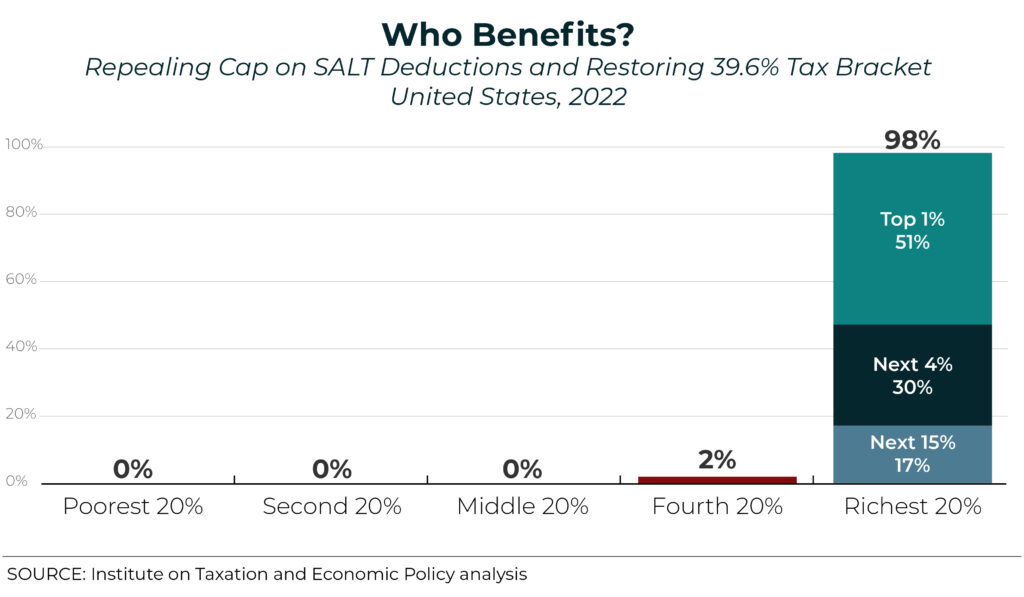

For example New York plans to establish a new charitable fund that will support health care and education among other programs that benefit New York residents. The SALT tax deduction is a handout to the rich. The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones.

New limits for SALT tax write off. No SALT no deal they said. We estimate that uncapping the SALT deductionrelative to current lawwould reduce federal revenue by 673 billion between 2019 and 2028 including roughly 81 billion in 2019.

It should be eliminated not expanded. The Second Circuit affirmed a district courts holding that although four states had standing to challenge the cap on the deduction for state and local taxes SALT the states failed to prove that the cap is unconstitutional. The SALT deduction is unfair because it disproportionately subsidizes states and localities with higher earners and higher income and property taxes.

9 hours agoA new bill seeks to repeal the 10000 cap on state and local tax deductions. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including one. Capping or eliminating SALT punishes people for living in areas that want or need to raise money to provide public services and double-taxing income strikes me as generally unfair in principle.

A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal income tax. The deduction for state and local taxes has been around since 1913 when the US. Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country.

Democrats from blue states such as New York and New Jersey have been pushing to include a rollback of the SALT deduction. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of their. Contributions taxpayers make to that fund will receive a state income tax credit equal to 85 of the contributions.

164 permits a federal deduction for taxes paid to state and local governments. The SALT tax deduction is a handout to the rich. A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion.

54 rows Some lawmakers have expressed interest in repealing the SALT cap. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Bill To Eliminate SALT Deduction Cap Introduced In Congress - Yorktown-Somers NY - Introduced by Rep.

Nov 2 2021. The revised SALT deduction is designed to raise revenue at least on paper because both plans would restore the 10000 cap for all after 2025. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000.

For instance if a taxpayer donates.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Dems Demanding Salt Tax Cuts Stand To Benefit

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Opinion The Debate Over A Tax Deduction The New York Times

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times